by George Lauer, California Healthline Features Editor

The moral of the story about a disagreement over what Blue Shield of California is expected to do in return for approval to enter the Medi-Cal managed care market appears to be “pay close attention to how things are worded.”

Consumer advocates and state officials thought the agreement this fall approving Blue Shield’s plan to buy Care1st Health Plan called for the insurer to increase its charitable contributions by $14 million a year for 10 years. However, neither the word “increase” nor language indicating that idea were included in the agreement. The text calls for Blue Shield to contribute “not less than $14 million a year.”

Blue Shield, which typically contributes more than $30 million a year to its charitable foundation, intends to abide by the agreement and not dip below $14 million. But neither does it plan to increase its charitable giving as part of this agreement, according to company officials.

“The ink’s not even dry a month after the deal was worked out and Blue Shield is weaseling out of what they said they’d do,” said Anthony Wright, executive director of Health Access California. “This violates the spirit and the expectation that everybody had during the negotiations. We shouldn’t let Blue Shield get away with this.”

It appears the issue has reached a standstill. State officials expressed their concern in a letter to Blue Shield. Blue Shield officials acknowledged receiving the letter but don’t intend to reply.

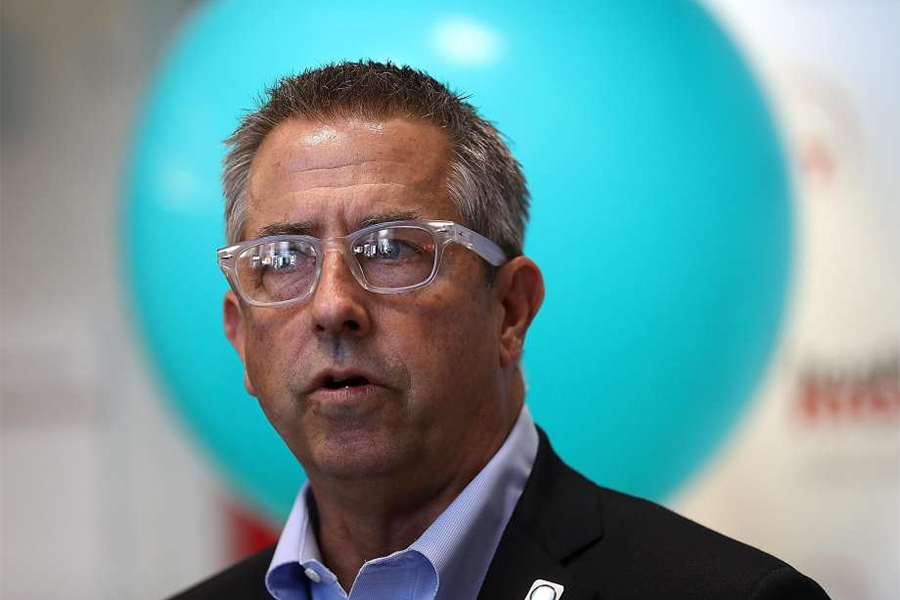

“As far as we’re concerned there is no disagreement and there is no attempt to weasel out of anything,” said Steve Shivinsky, vice president of Blue Shield of California. “We are honoring the agreement that we negotiated,” Shivinsky said.