Seven Tips to Empower Your Decision-Making

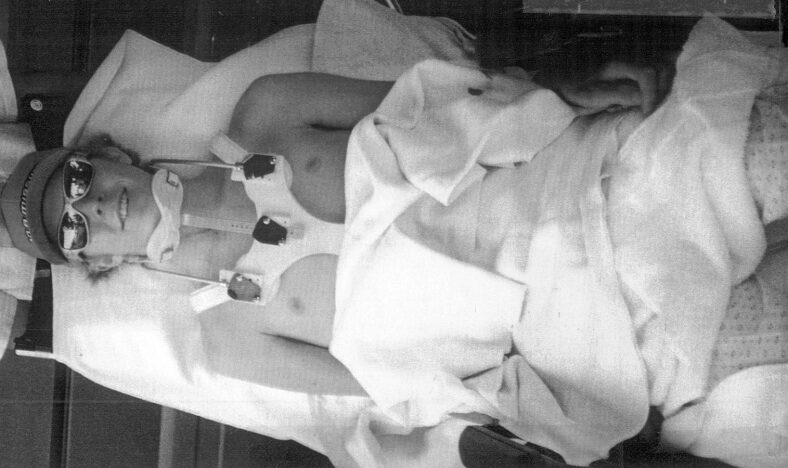

When I was injured with a spinal cord injury at the age of 21, I was financially irresponsible. I was an athlete using my parent’s gas card for grocery shopping and race gas. I had no thoughts of the future, or planning for the what-ifs. Now having an injury, a family to provide for, and businesses that I am in charge of, I think of my legal and financial goals daily. From healthcare expenses to disability benefits and legal rights, understanding and managing all of these aspects is crucial for ensuring a stable life.

Here are seven tips that I have learned (the hard way) to be valuable in everyday life, spinal cord injury, or not.

1. Seek Professional Guidance Early On:

When dealing with legal and financial matters, it is important to consult with professionals who specialize in your specific areas. You may consider hiring an attorney with expertise in disability law, personal injury, or insurance claims if you have any pending matters. Financial advisors can also help you create a financial plan tailored to your specific needs and circumstances. We have recently hired a team to work with us personally and with our businesses.

2. Understand Your Insurance Coverage:

One of the first steps is to review your insurance policies – health, auto, and (if you have it) long-term disability insurance. Make sure you understand the extent of your coverage, including what is covered and any exclusions.

3. Explore Disability Benefits:

Based on where you live, you may be eligible for federal or state disability benefits such as Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI). These programs can provide financial support to help cover living expenses and medical costs. I was blessed to have these benefits in the beginning which assisted in my recovery, helped foster independence, and contributed to my future productivity and re-entry into society.

4. Know Your Legal Rights:

Individuals with disabilities and spinal cord injuries have legal rights to protect them from discrimination and allow them to have equal access to education, employment, and public spaces. The Americans with Disabilities Act (ADA) and other relevant legislation safeguards those rights. In today’s expanding inclusive world, hopefully these issues will become less common! Read more about the ADA in a blog I wrote HERE.

5. Plan for Long-Term Care:

Living with a spinal cord injury often requires long-term care. It is important to prepare a detailed and extensive care plan that addresses all physical and emotional needs. A financial advisor can help you budget for ongoing expenses, such as hiring caregivers.

6. Establish a Trust:

A special needs trust can protect your eligibility for government benefits. This legal arrangement manages funds for future care without jeopardizing any access to programs like Medicaid or SSI.

7. Build a Support Network:

After a spinal cord injury, life can be emotionally and financially overwhelming. Lean on family, friends and support groups for emotional support, advice, and resources. You can read more about support groups in your area HERE.

I understand that living with a spinal cord injury is challenging, but if you surround yourself with the right people and advice, you can come out ahead! Explore professional guidance, educate yourself about legal rights, and plan strategically to guarantee you have the legal and financial support necessary for a full life.

In Health,

Aaron